You are currently browsing the category archive for the ‘International Business’ category.

My March 30th post (Taiwan’s Historic Split Screen) was written as President Tsai Ing-wen arrived in New York in transit on her diplomatic visit to Central America. That piece promised a follow-up on the occasion of her return transit to Los Angeles — and meeting with Speaker of the House Kevin McCarthy — en route back to Taiwan. The Tsai-McCarthy meeting took place 6 days ago on April 5th but I delayed following up until today because my interview with Forbes on this topic was in the works.

That Forbes interview was published yesterday and can be found here (including 12 minute audio version). I am also reproducing that interview below to capture it in the Assessing China blog. It begins with several scene-setting paragraphs by Forbes Editor at Large Russell Flannery. The interview itself begins below the photograph of Micron headquarters in Shanghai.

(Begin article)

Micron Probe May Hurt China’s Efforts To Attract Foreign Investment

Beijing today wound down its latest large-scale military exercises in the waters around Taiwan but overall tension between the U.S. and China remains high. China’s moves followed a high-profile meeting last week between U.S. House Speaker Kevin McCarthy and Taiwan President Tsai Ing-wen in Los Angeles criticized by mainland leaders who claim sovereignty over self-governing Taiwan.

On the commercial front, the semiconductor industry remains an elevated point of stress. Beijing earlier this month announced a cybersecurity review of U.S. chipmaker Micron aimed, it said, at protecting the country’s information infrastructure and national security. The probe comes at a time when China has been seeking to boost foreign investment to accelerate its economic recovery from “zero-Covid” policies that slowed growth.

What’s next for U.S.-China ties and also for the CHIPS Act, the U.S. law enacted last year aimed at reversing the declining American share of global semiconductor production?

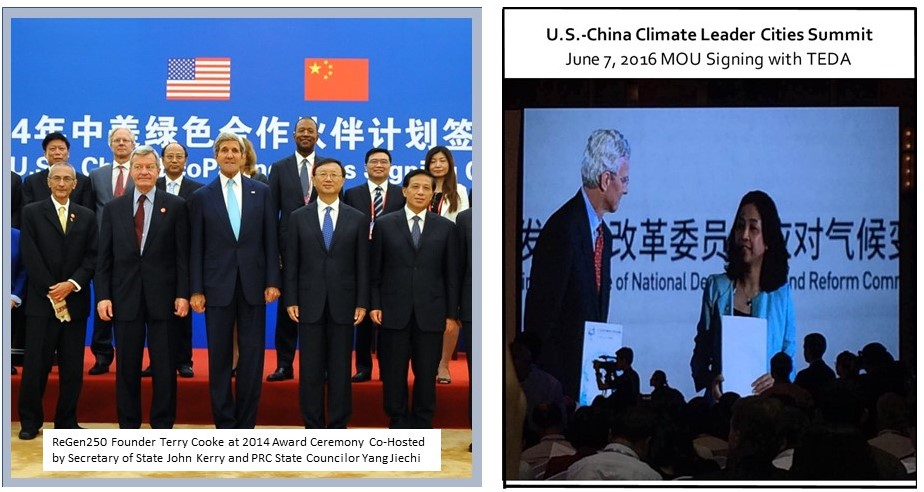

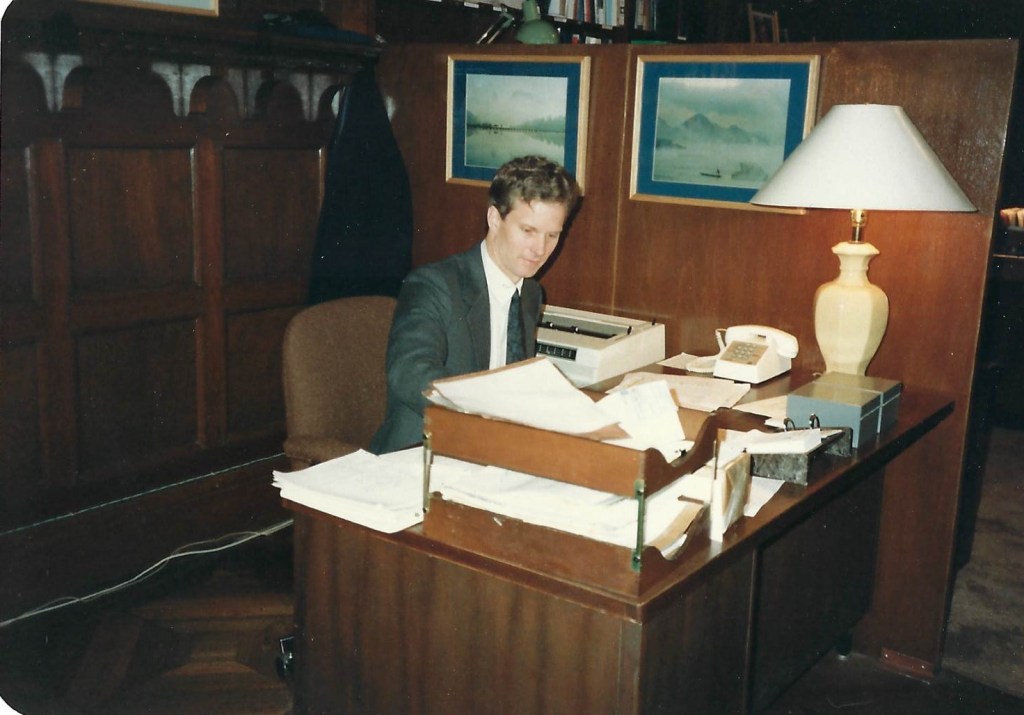

To learn more, I spoke on Saturday in the Philadelphia area with Terry Cooke, a senior fellow at the Foreign Policy Research Institute, a think tank focused on U.S. national security and foreign policy. Cooke, a former career U.S. senior foreign commercial service officer with postings in Shanghai, Taipei, Tokyo and Berlin, currently leads ReGen250, a non-profit that focuses on U.S.-China green energy collaboration as well as environmental regeneration initiatives in the tri-state Greater Philadelphia region.

Cooke believes China’s move against Micron will have “a chilling effect for potential foreign investors — definitely on the U.S. business community” at a time when China is trying to win new foreign investments following the end of “zero-Covid” policies at the end of last year that had harmed economic growth. Beijing high-profile efforts to pressure Taiwan militarily may also be counterproductive if Taipei successful builds itself up as “an important force” in a larger, more influential network of democracies. Edited excerpts follow.

© 2023 BLOOMBERG FINANCE LP

Flannery: What do you make of the military exercises around Taiwan this month?

Cooke: There are two ways of looking it. One is that going into the Tsai-McCarthy meeting, the decision had already been made (in Beijing) that this is the new normal, that whenever there is an uncomfortably high-level contact between the U.S. government and the Taiwanese government, we (the Chinese government) are just going to keep demonstrating our ability to militarily squeeze Taiwan through maneuvers of this sort.

There is, however, another way of thinking about it: the way the McCarthy-Tsai meeting was conducted may, in fact, have been the determinant of the maneuvers. Beijing may have been in a wait-and-see mode. They of course issued their standard and predictable verbal denunciations in advance of Tsai’s transit stops.

I think they were waiting to see how low-key the meeting in L.A. with McCarthy would prove to be. The entry through New York was very low-key. The State Department utterances for most of the trip also kept things low-key. And there was ample precedent for this given Tsai’s previous six transit visits to the U.S. so the State Department position was that there was no reason for Beijing to make an issue out of it.

But the optics of McCarthy meeting – with all the diplomatic trappings of a government-to-government meeting save for flags set up on the table – made it look very much like an official meeting. And I don’t think that went over well in Beijing. That could have triggered the decision to trot out the military.

Flannery: So what’s next?

Cooke: Just as the U.S. is maybe on its back foot with the new realities in the Middle East, I think China may be on its back foot in terms of the game of diplomatic recognition when it comes to Taiwan. Yes, Taiwan just lost Honduras on the eve of Tsai’s U.S. trip. Now, Taiwan is down from 14 to 13 countries that it has diplomatic recognition with.

But I think there’s really a more important game in town now than adding up the number of formal diplomatic allies. This new game in town probably started around February 2021 with the Biden administration moving into the White House. To many people’s and particularly Beijing’s surprise, Biden kept Trump’s tough China policy. He also introduced into his speeches and policies a clear and consistent autocracy-vs-democracy contrast.

Within the context of this U.S.-led “reframing” of the global picture, Taiwan now has the opportunity to reposition itself within the team democracy global network of supporters in a way that it’s not strictly about formal recognition and UN membership. It’s about being recognized, and in some ways, held up as an important force in this network of democracies.

Flannery: How will Taiwan’s presidential elections next year affect these three-way ties?

Cooke: From the U.S. governmental standpoint, the outcome – whether it is a victory for Tsai’s Democratic Progressive Party or the opposition KMT party – will change hardly at all. This is because the U.S. government’s official position – whether it involves the outcome of an election in Taiwan or changes to the cross-strait status quo initiated by China – is that what the 24 million people of Taiwan choose for themselves is what the U.S. government will support. I don’t think our basic diplomatic posture and our support for Taiwan would change unless there was some evidence — which I would not expect at all — of some malfeasance happening with the election.

Flannery: What do you make of China’s probe into Micron?

Cooke: We can dissect it into several elements. One is a desire for reciprocity and being seen on an equal plane. And so with Biden’s CHIPS Act, and the singling out of TikTok and a lot of different Chinese companies in U.S. security investigations, it’s to be expected that there is going to be some reciprocal action that China is going to want to take to be seen as a peer power demanding reciprocity.

That diplomatic posturing is understandable but it does have a chilling effect for potential foreign investors — definitely on the U.S. business community. Close allies in Europe and elsewhere notice it, and it doesn’t help China’s post-pandemic effort to show a welcoming face to foreign investment.

I think there is also a third element of it that is interesting: perhaps as another data-point showing a lack of coordination in Chinese policy and messaging that we see from time to time. And we’re living in a world where nobody is a paragon and the U.S. has its own challenges with coordinating its message. But in China, as we saw recently with ‘wolf-diplomacy’ and the balloon incident, people lower in the governmental hierarchy vie to please their superiors, and end up getting out in front of the intended policy and in front of what would be an optimal coordinated policy for China. And I’m wondering personally whether Micron might be an instance of that.

Flannery: Speaking about both semiconductors and Taiwan, does the U.S. rely on Taiwan too much for chips?

Cooke: It’s actually in almost everyone’s interest at this point to have a greater degree of global diversification. It’s outright dangerous to have close to 90% of production of the world’s most advanced semiconductors taking place only 90 miles away from the Chinese mainland.

Flannery: Does the CHIPS Act go far enough in striking a new balance?

Cooke: Before the CHIPS Act, Taiwan Semiconductor Manufacturing Company (TSMC) was already taking steps (to diversify from Taiwan). There are currently moves afoot in Germany for automotive chip production — not the most advanced chips in the world — but also with Japan for consumer electronics and with Arizona for an advanced generation of chips. (See related post here.) For the foreseeable future, production of ultra-advanced chips will stay in Taiwan. But I think a lot of production capacity for quite advanced chips is being pushed out of Taiwan to these other global nodes.

The CHIPS Act is to my mind pretty fascinating. As a response to China’s Made-In-China-2025 ambitions and its military upgrading, it’s a bulls-eye in my view. But, as a policy undertaking in the U.S. domestic context, it is something of a potential third rail in the sense that, as a country, we’ve never been comfortable or particularly skilled at industrial policy. And it is clearly industrial policy.

Interestingly, I think there is enough bipartisan support right now that the industrial policy-political debate on Capitol Hill is not the traditional debate of “no industrial policy” versus, let’s say, the Clinton era’s “auto industrial policy for Japan.” Nobody at this point seems to be openly challenging the need for an industrial policy response to China’s advanced technology challenge.

So the debate currently is one about “clean” industrial policy versus industrial policy with social agenda items folded into it, like childcare support for workers. (Either way) it is important as a signal to the market about U.S. government resolve.

Flannery: Is it enough? And if it’s not enough, what’s the next step?

Cooke: If, in version one, the sum had been significantly higher than $52 billion, it would have been almost setting itself up for failure, because there are so many things that can go wrong in operationalizing and implementing something like this.

By analogy in the military sphere, we have put in a very robust sanctions regime against Russia following the invasion of Ukraine. But it was kind of uncharted territory. There’s been a lot of analysis about what’s been working and what hasn’t been working. We’re groping our way forward and want to keep some powder dry.

The CHIPS Act is similar in the commercial sphere — kind of uncharted territory. One of the things it has going for is that Commerce Secretary Gina Raimondo is an astute leader of the process. In the current political environment, any sign of dropping the ball would be pounced on. What is actually more important than the amount of money is the fact that it has happened in an initial iteration. There can be subsequent iterations, but it’s important to operationalize the first iteration as well as possible and to learn from that process to inform a potential second iteration.

Flannery: There is controversy about social goals being attached to it.

Cooke: The Act was passed by Congress last year, and it went into a kind of holding period where no one knew what the process was going to be for a company to apply. When the guidelines were only recently announced, it became clear that there was quite a lot of conditionality put on the ability of a company to apply. One set of conditions has to do with an applicant limiting its China business for a 10-year period. Another quite different set has to do with an awarded company providing childcare for its employees.

I think the criticism about these conditions is a fairly predictable output from the Washington DC political meat grinder. Because these are tax-payer dollars, the back-and-forth is highly political. Placing limitations on future China business for awardees makes sense to the average American voter. However, those limitations raise serious concerns for the CEO of a sizable company that doesn’t want to decouple from the China market but does want to access CHIPS Act support. On the separate issue of childcare, this requirement is meant as an incentive to help overcome the problem of a shortage of chip production workers in the U.S but it obviously becomes a red meat talking point for politicians who position themselves as anti-woke in U.S. culture wars skirmishing.

This goes back to what we were talking about before with Micron. China is currently unable to respond in a meaningfully reciprocal way when the U.S. does things like put Chinese billionaires onto an entities list. They just don’t have a global finance tool that is anywhere near as sharp and strong as is found in the U.S. Treasury toolkit. For the U.S., putting companies on an entities list works— it catches the attention of targeted individuals and there is an important and broad public messaging dimension to it as well. Of course, to make sanctions really bite, there’s a lot of operationalization that needs to happen but doesn’t always happen.

What I personally believe is: China’s main effort now is to try to knock the dollar off its post-World War II throne. Others have tried and failed and it will be a hard thing for China to pull off. But I believe that’s this the main thrust of their effort and the primary aim of a long-term, patient strategy.

See related posts:

U.S. Businesses Look To De-Risk, Not Decouple, Their China Ties

U.S.-China Collaboration Could Cut Development Time, Cost For New Cancer Treatments

TSMC Will Triple Arizona Investment To $40 Billion, Among Largest Foreign Outlays

Taiwan’s Biggest Silicon Wafer Maker Eyes U.S. Solar Industry Investment

@rflannerychina

Send me a secure tip.

(End article)

I join Russell in inviting you to leave your thoughts or questions in the Comment section below. (Because of netizen ire in China, I have not always kept the Comments section open in Assessing China but it is open for this post. I would love to hear from you).

On January 13th of this year, President Trump abruptly ordered the termination of the U.S.-China EcoPartnership Program. Seven days before leaving office and without notice, Trump turned the lights off on this 10-year old program, pulling the rug out from under 36 committed and on-going bi-national projects to lower carbon-emissions at global scale.

The Biden Administration is assessing its options for re-vitalizing, in some shape or form, this model of innovative and impactful public-private collaboration to put a dent in global greenhouse gas emissions. This might involve replication of the program to India. ReGen250 is already in the starting gate with a U.S. Mid-Atlantic/State of Maharashtra candidate program should that take shape, as is described on pages 8-9 of our article published last month in the peer-reviewed science journal Environmental Progress and Sustainable Energy.

In the meanwhile, we are pressing forward with unofficial support from the two U.S. Government agencies which ran the EcoPartnership program for ten years — the U.S. Department of State and the U.S. Department of Energy — on a purely private and sub-national basis. Our goal in China looking forward is to explore the possibility of expanding from a regional effort (low-carbon collaboration between the U.S.-Mid-Atlantic and the Jing-Jin-Ji (京津冀) region of Beijing, Tianjin and Hebei Province to national scale.

How will we accomplish this without the direct support of the U.S. Government? The first step was to confirm the Biden Administration’s encouragement of trade with China in support of Paris Accord goals and then to renew our region-to-region BE Better program partnership with our primary partner in China, the TEDA EcoCenter. These steps were taken last quarter.

The next steps involve exploring prospects for the resumption of the Sino-U.S. Eco Park national-level opportunity with the Green Development League as outlined at the 2020 U.S.-China EcoPartnership Summit. (As described in detail in a prior post, the Green Development League comprises the 36 top-ranked NETDZs throughout China and the GDL Secretary-General is our original EcoPartnership partner (the TEDA EcoCenter and its Director Madame Yuyan Song).

As the exclusive U.S.-based working group member for the proposed Sino-U.S. Eco Park, China Partnership would leverage expertise and input from (1) our region-to-region BE Better program partners (experts in “energy-efficient, smart and healthy built environments” for industrial park users) as well as (2) our U.S.-China BEST Cities partners (with additional constituencies of support to include the U.S.-China Business Council, the U.S. Industry Advisory Board of the U.S.-China Clean Energy Research Center for Building Energy Efficiency (CERC-BEE), the National Governors Association, and the National League of Cities) in order to identify a comprehensive range of U.S. clean energy technologies and infrastructures from across eastern, central and western regions of the United States to be incorporated into the Sino-U.S. BE Better Eco Park model.

The primary impact of this milestone — CPGP’s formally joining the Green Development League’s working group for design of a Sino-U.S. Eco Park with scalability and replicability to multiple locations throughout China — is literally “to put the U.S. on the map” alongside eight other similar International Eco Parks already functioning in China under PRC Ministry of Commerce auspices. These eight other Eco Park projects represent mostly Sino-European collaborations (e.g., Sino-German Eco Park, Sino-Swiss Zhenjiang Eco Park, Sino-Austrian Eco Park, Sino-Finland Beijing Eco Park) and, to date, none represents a Sino-U.S. collaboration. The CPGP/U.S.-China BEST Cities model was selected, following the March 27, 2018 deadline for application, due to its unique structure of open collaboration designed to introduce U.S. urban clean energy infrastructures and technologies to TEDA and the 35 other top National Economic-technological Development Zones (NETDZ) in the Green Development League.

Using comparables drawn from the realized, real-world experience of the Sino-German Eco Park in Dalian but adjusted to account for the relatively greater GDP of the U.S., a Sino-U.S. BE Better Eco Park leveraging our EcoPartnership’s platform of energy-efficient, smart, healthy built environment and clean manufacturing for industrial park application should reasonably be expected to realize within its initial 5 years:

• As many as 300 signed project agreements (with nearly 60% of those either in production or under construction during that timeframe) representing total investment of 100 billion RMB (approx. USD 15 billion at today’s exchange rate)

• As many as 90 of these projects would be expected to fall in the high-end manufacturing and new energy field with total investment of 67.5 billion RMB (approx. USD 10 billion at today’s exchange rate)

• As many as 80 of these projects would be expected to fall in the advanced services sector with total investment of 35 billion RMB (approx. USD 5 billion at today’s exchange rate)

We are now actively exploring the most practical route for realizing this goal which would involve resumption, post-Trump Administration, of our primary partnership model with (a) TEDA, (b) the 36 GDLs and (c) the 219 NETDZs. Additionally, we have recourse to a secondary partnership model focused on the Jing-Jin-Ji/Xiongan New Area mega-development project.

With respect to the 35-year macroeconomic development effort ushered in by Deng Xiaoping and the Shenzhen and Pudong macro-development projects, Xiongan has both continuities and distinctive differences. One similarity is the size envisioned for the Xiongan New Area -– roughly 50% bigger than Pudong (east of Shanghai) and slightly larger than Shenzhen (to the north of Hong Kong). While Xiongan can be thought of as culminating the coastal progression of these macro-projects–- starting in the south with Shenzhen in the 1980s and moving to the central coast with Pudong in the 1990s -– the final, northern leg of this triad was wobbly at first. President Hu Jintao and Premier Wen Jiabao initially envisioned the third macro-project leg as being Binhai to the northeast of Tianjin. Post-2012, however, plans for Binhai lost most of their momentum and it was only with President Xi Jinping’s emergence in power that priority was shifted from Binhai to Xiongan. It is more in the discontinuities between Xiongan and the earlier Shenzhen and Pudong macro-projects that Xiongan’s significance can best be understood. The first 30 years of the PRC’s post-Cultural Revolution industrial development was based on a high-carbon model. (This is frequently referred to in China by the phrase 先污染后治理 meaning “pollute first, clean up (or remediate) later”). In contrast, the Xiongan industrial model championed by Xi Jinping focuses on a different set of values for the next 30-year-or-so phase of China’s development in the 21st century: the goals of (1) promoting and putting into practice low-carbon industrialization and sustainability innovations and (2) lessening social inequality and narrowing the gap between rich and poor in shared benefits of industrialization and economic development.

Among the few dozen officially-awarded U.S.-China EcoPartnerships, the PHL-TEDA EcoPartnership is unique in its design as an open platform to facilitate collaboration among businesses, local governments, universities and non-governmental organizations (NGO). On the U.S. side, the platform is anchored by China Partnership of Greater Philadelphia (CPGP, a 501c3 non- profit) and its public sector partner, the Commerce Department of the City of Philadelphia. The first stage of this collaboration has involved bringing sustainable-city-type BE Better technologies (built environment technologies that are more energy-effiient, smarter and healthier) to our EcoPartnership partner in Tianjin (TEDA). Our longer-term objective is to scale these BE Better technologies throughout China through the network of its national-level industrial parks. The initial stage of this scaling effort focuses on China’s northeastern Jing-Jin-Ji region (comprising Beijing, Tianjin and Hebei Province) through collaborations with Green Development League-member National Economic-Technological Development Zones (NETDZ) in Beijing, Tianjin and Langfang. The longer-term goal is to position for second-stage, nation-wide expansion of the BE Better model through the Green Development League’s 36 member- NETDZs nationwide and through the Ministry of Commerce’s national Eco Park program.

On January 13, 2021 — a scant week short of President-elect Biden’s inauguration — President Trump turned off the lights on this decade-old government-to-government program between the U.S. and China to advance climate change mitigation efforts in both countries. Nonetheless, the PHL-TEDA effort was always conceived as a private-sector driven effort and — with continuing legacy support from the U.S. Departments of Energy and State — we are advancing our BE Better program with our TEDA partner in China and exploring possible broadening of the program to the state of Maharashtra in India.

The complete story of where we have been and where we are going is presented in the attached peer-reviewed article published online earlier this month by the Wiley-owned journal Environmental Progress & Sustainable Energy. The print version of the article will be published in the next few weeks.

The full article can be read by clicking here or on the image below:

We encountered headwinds along the way — a fraudulent bid procurement, Trump’s announced intent to withdraw the U.S. from the Paris Accord, the Tariff War — but, by tacking and keeping our eye fixed on our destination, we have gotten to calmer waters and now have a following wind. Stay tuned for the next leg of the journey.

In July 1989, I was at my desk at the U.S. Consulate General Shanghai when I received a call notifying me that a small group of senior officials from the Shanghai Municipal Government would be coming for a meeting that afternoon. I was asked to make sure that the newly-arrived Consul General — Pat Wardlaw who had just replaced my first Consul General Charlie Sylvester earlier in the month — join the meeting.

A couple of things about this. First, you’ll note that a meeting wasn’t actually requested and that none of us were asked about our availability in the afternoon. We were instead informed that the group of government officials would be coming and we were simply expected to be available when they arrived. Second, anyone who has worked in China will notice something quite extraordinary about this phone call. We were not summoned, as is typically the case with Chinese government officials, to go meet with them at their offices. They were coming to us. This would be the only time in my working career in China when Chinese government officials came to us rather than vice versa.

A word of context. This phone call took place in the latter half of July, a month and a half after the June 4th Tiananmen incident. Roughly a week before June 4th, my wife Grace and I had left Shanghai on a one-month Home Leave, traveling first for one week vacation with my sister’s family on Kauai and then expecting to spend the remainder of our time in Philadelphia with family and with me traveling to Washington DC on consultations. As we transited San Francisco International Airport on June 4th to catch our onward flight to Philadelphia, there was a palpable tension in the air and we soon saw the near-identical banner headlines about Tiananmen in a row of vending machines along the terminal wall as we made our way to Passport Control.

I never got my homeleave or consultations in Washington. Secretary of State Jim Baker was determined to have his thumb on the pulse of decision-making by McDonnell-Douglas, 3M, Johnson & Johnson, Coca-cola and the other top U.S. investments in Shanghai. He knew it wouldn’t be reliable to just count on what he heard from the CEOs at U.S. headquarters. He wanted to know the calculus of decision-making that was taking place on the ground by the Shanghai-based executives in charge of the major U.S. investments in Shanghai. Having just landed in Philadelphia, I was given one-day to help Grace (early in her pregnancy with our older son Todd) get settled in and was instructed to then turn around and fly back to Shanghai to start providing anything I could learn from my business contacts in Shanghai in a series of classified cables.

So back to the July meeting. The Consulate guard (not a Marine because no U.S. military presence was allowed in China at that time) notified me that the government officials had arrived. I escorted the group of four or five officials into the ground-floor meeting room where a handful of my Consulate colleagues were waiting. One of the officials was just barely managing to carry a big armful of long paper rolls. They did not wait to be seated and didn’t begin with any pleasantries. The senior official simply took the first roll of paper handed to him, unrolled it on the conference room table and announced “This will be the new Pudong. We want you to report about Pudong to your government. We want Americans to invest and help develop it. They will make a lot of money.”

¤ ¤ ¤ ¤ ¤ ¤

Today’s post falls into the TEA Collaboratives’ A-Series of content dealing with PRC government planning Ambitions. Over the weeks and months ahead, I will have a chance to share insights developed through the Masters-level course (IMPA 608) which I taught at the University of Pennsylvania in the spring semester of 2019 and 2020. The focus of that course, based on Mandarin language research, is the forty-year trajectory of China’s macro-development planning vision and execution. Domestically, the trajectory of that storyline begins with Shenzhen in the early 1980s, continues smoothly through Pudong throughout the 1990s before encountering turbulence in Tianjin in the 2000s. Following 2012, the first stage of this macro-development model gets jettisoned and the second stage ignites with the twin megalopolis projects — the Consolidated Beijing-Tianjin-Hebei Project (‘Jing-Jin-Ji’ or 京津冀) in the northeast and the Guangdong-Hong-Kong-Macao Greater Bay Area Project in the southeast. Simultaneous with the unveiling and cranking up of this pair of Version 2 domestic macro-development projects over the last decade, China has also been systematically extending its macro-development model to its 139 international partners through the Belt & Road Initiative.

I look forward to sharing the insights gleaned from this multi-year, instructor-and-student knowledge co-creation effort in the TEA Collaborative’s A-series blogposts on Fridays over the remainder of the year. Understanding the vision and values driving the momentum of this forty-years macro-development effort helps chart where China is headed in the future. I hope this small, personal anecdote about Pudong’s emergence into China’s macro-development planning process serves as an apt way to kick off our Macro-Dev series.

On June 8th, the Biden Administration announced immediate actions it was taking to address near-term vulnerabilities in four critical supply chains as identified by a 100-day America’s Supply Chains assessment initiated in late February. The four critical supply chains included in this announcement are: semiconductor manufacturing and advanced packaging; large capacity batteries, like those for electric vehicles; critical minerals and materials (so-called “rare earths”) used in smart phones, electric vehicles, wind turbines and other advanced technologies; and pharmaceuticals and active pharmaceutical ingredients (APIs) used in vaccines and other applications.

Today’s post takes an initial high-level view of the critical supply chain for semiconductor manufacturing and examines the shifting fault-line of vulnerability. Subsequent posts in the Global TECHtonics series will take a much closer look at these and related issues.

Photo: barks/Adobe Stock

What is the Fault-line?

The semiconductor supply chain fault-line runs directly under Taiwan, whose chip foundries produce 92% of the world’s most advanced microchips (which have transistors less than one-thousandth the width of a human hair). The small island is caught between the tectonic forces of the China market (which accounts for 53% of global semiconductor consumption and the U.S. market (which accounts for the vast majority of the advanced designs on which Taiwan chip production is based). In addition to these market forces, political dynamics add to the stresses along this fault-line. While China claims Taiwan as an inalienable part of its territory, the U.S. has been serving as the guarantor of Taiwan’s de facto independence since 1949. In more recent years, the Trump Administration’s “Tariff War” against China has given impetus to a process of technology “de-coupling” which is forcing Taiwan companies – especially its preeminent foundry manufacturer Taiwan Semiconductor Manufacturing Company (TSMC) – to choose between the fast-growing China market (34% revenue growth since 2014) and its slower growing (4% growth) but highly strategic U.S. customers, including the U.S. military. The fact, for instance, that 14 of TSMC’s 17 foundries worldwide (and all of its foundries capable of higher-end production above the 16 nanometer level) are located in Taiwan at a distance of just 90 miles from the PRC mainland adds to the tectonic friction.

What is the Trend-line?

Subsequent posts in the Global TECHtonic series (approximately two per month) will examine a broad range of dynamics in detail to include the impact of the COVID-19 pandemic on global microchip supply chains, specific dynamics within microchip subproduct categories (logic chips, analog chips, memory chips, etc), TSMC’s strategic response to the increasing global pressure and detailed analysis of trends within the U.S. semiconductor industry. Today’s post will limit itself to two broad brush-strokes to suggest the general trend-line: (1) the twenty-year trend-line since 2001 and (2) the one-year trend-line since 2020.

- The accession of China and Taiwan to the World Trade Organization (WTO) in 2001 led to hopes that Information and Communications Technologies (ICT) supply chain tensions might start easing but, from 2008 at least, the opposite has proved true. Following the Global Financial Crisis, market forces and competitive tensions increased pressures on ICT supply chains markedly and these pressures further accelerated starting in 2012 following the 18th Chinese Communist Party Congress in 2012. (Readers interested in a deeper understanding of the ICT supply chain dynamics covering the period 2001-2008 can refer to Congressional Commission testimony I provided during the 107th, 108th and 109th Sessions of Congress as well as to my article in the edited volume Economic Integration, Democratization and National Security in East Asia (Peter Chow, Elgar Publishing) and my article in The Journal of Contemporary China (Volume 13, Number 40, 2006).

- The past year has shown some notable shifts along this fault-line. In Taiwan, policies instituted by President Tsai Ing-wen have led to a small shift in Taiwan’s trading dependence on China and to larger shifts in the pattern of outbound and inbound investment involving China. Specifically, the Tsai Administration’s New Southbound Policy has shifted a small portion of Taiwan’s trade in consumer electronics away from China in favor of Southeast Asian markets. More notably, the “Invest Taiwan” program has exceeded its targets and much of the reinvestment in Taiwan comes as a result of production being repatriated from the mainland. As for outbound investment from Taiwan in ICT sectors, recent trends favor the U.S. as a destination rather than China. In March 2020, TSMC announced that it would be building a $12 billion microchip production plant in Arizona. Meanwhile, tighter regulations by Taiwan’s Investment Commission has led to a 60% drop in outbound investment to the mainland since 2018.

It is for these and other reasons that the New York Times recently proclaimed “pound for pound, Taiwan is the most important place in the world.” The Strait of Hormuz may have been the world’s most dangerous fault-line in the 20th century oil economy. In the 21st century, the tectonic pressures of the global economy now converge on the Strait of Taiwan.