You are currently browsing the tag archive for the ‘china’ tag.

Hello TEA Collaborative Subscribers,

It has been some time. I remain deeply appreciative for your interest in the TEA Collaborative over past years. You will have noticed that activity on the TEA Collaborative trailed off to full silence during the pandemic but you were never given an explanation for this trailing-off or told what to expect.

I am writing to address that now. The TEA Collaborative was a “triad x 2” model of Teaching, Engagement and Analysis focused on Technology, Energy and (Political) Ambition in China. Due to the pandemic, my masters-level course at Penn (“The U.S. & China in the 21st Century”) was abruptly and quite disappointingly discontinued in July 2020. With the loss of that teaching role, the raison d’être of the TEA Collaborative also vanished.

However, I am continuing the Engagement and Analysis pieces of the TEA Collaborative with as much passion as ever and with a sharpened focus on competition between the U.S. and China in three specific areas: semiconductor industries, artificial intelligence development and AI infrastructures (energy, workforce, etc). I am doing some of that work through my GC3 Strategy consultancy business, some of through my Senior Fellow role at the Foreign Policy Research Institute (FPRI) and some of it through my new China Now & Then publication on Substack.

I am writing today not just to say goodbye but also hello. I will be discontinuing the TEA Collaborative website on WordPress over the months ahead but I am opening up a new China Now & Then publication series on Substack. I am excited about this new platform and warmly invite you to join me on it here.

You will notice that this is just getting underway and that the China content is not yet disaggregated from the other themes. That will happen though and the China content will brought together in its own publication with a modest subscription fee. I am encouraging you to subscribe now — free of charge — and am offering you as a TEA Collaborative subscriber the chance to receive a free lifetime subscription to China Now & Then before it is offered to the public on a fee-basis.

If you are interested, please do so today by Subscribing here. Please note that, for this offer, you will need to select Subscribe from the prompt (remember it’s free now and will remain so for you) rather than Follow.

Hope to see you there soon.

My March 30th post (Taiwan’s Historic Split Screen) was written as President Tsai Ing-wen arrived in New York in transit on her diplomatic visit to Central America. That piece promised a follow-up on the occasion of her return transit to Los Angeles — and meeting with Speaker of the House Kevin McCarthy — en route back to Taiwan. The Tsai-McCarthy meeting took place 6 days ago on April 5th but I delayed following up until today because my interview with Forbes on this topic was in the works.

That Forbes interview was published yesterday and can be found here (including 12 minute audio version). I am also reproducing that interview below to capture it in the Assessing China blog. It begins with several scene-setting paragraphs by Forbes Editor at Large Russell Flannery. The interview itself begins below the photograph of Micron headquarters in Shanghai.

(Begin article)

Micron Probe May Hurt China’s Efforts To Attract Foreign Investment

Beijing today wound down its latest large-scale military exercises in the waters around Taiwan but overall tension between the U.S. and China remains high. China’s moves followed a high-profile meeting last week between U.S. House Speaker Kevin McCarthy and Taiwan President Tsai Ing-wen in Los Angeles criticized by mainland leaders who claim sovereignty over self-governing Taiwan.

On the commercial front, the semiconductor industry remains an elevated point of stress. Beijing earlier this month announced a cybersecurity review of U.S. chipmaker Micron aimed, it said, at protecting the country’s information infrastructure and national security. The probe comes at a time when China has been seeking to boost foreign investment to accelerate its economic recovery from “zero-Covid” policies that slowed growth.

What’s next for U.S.-China ties and also for the CHIPS Act, the U.S. law enacted last year aimed at reversing the declining American share of global semiconductor production?

To learn more, I spoke on Saturday in the Philadelphia area with Terry Cooke, a senior fellow at the Foreign Policy Research Institute, a think tank focused on U.S. national security and foreign policy. Cooke, a former career U.S. senior foreign commercial service officer with postings in Shanghai, Taipei, Tokyo and Berlin, currently leads ReGen250, a non-profit that focuses on U.S.-China green energy collaboration as well as environmental regeneration initiatives in the tri-state Greater Philadelphia region.

Cooke believes China’s move against Micron will have “a chilling effect for potential foreign investors — definitely on the U.S. business community” at a time when China is trying to win new foreign investments following the end of “zero-Covid” policies at the end of last year that had harmed economic growth. Beijing high-profile efforts to pressure Taiwan militarily may also be counterproductive if Taipei successful builds itself up as “an important force” in a larger, more influential network of democracies. Edited excerpts follow.

© 2023 BLOOMBERG FINANCE LP

Flannery: What do you make of the military exercises around Taiwan this month?

Cooke: There are two ways of looking it. One is that going into the Tsai-McCarthy meeting, the decision had already been made (in Beijing) that this is the new normal, that whenever there is an uncomfortably high-level contact between the U.S. government and the Taiwanese government, we (the Chinese government) are just going to keep demonstrating our ability to militarily squeeze Taiwan through maneuvers of this sort.

There is, however, another way of thinking about it: the way the McCarthy-Tsai meeting was conducted may, in fact, have been the determinant of the maneuvers. Beijing may have been in a wait-and-see mode. They of course issued their standard and predictable verbal denunciations in advance of Tsai’s transit stops.

I think they were waiting to see how low-key the meeting in L.A. with McCarthy would prove to be. The entry through New York was very low-key. The State Department utterances for most of the trip also kept things low-key. And there was ample precedent for this given Tsai’s previous six transit visits to the U.S. so the State Department position was that there was no reason for Beijing to make an issue out of it.

But the optics of McCarthy meeting – with all the diplomatic trappings of a government-to-government meeting save for flags set up on the table – made it look very much like an official meeting. And I don’t think that went over well in Beijing. That could have triggered the decision to trot out the military.

Flannery: So what’s next?

Cooke: Just as the U.S. is maybe on its back foot with the new realities in the Middle East, I think China may be on its back foot in terms of the game of diplomatic recognition when it comes to Taiwan. Yes, Taiwan just lost Honduras on the eve of Tsai’s U.S. trip. Now, Taiwan is down from 14 to 13 countries that it has diplomatic recognition with.

But I think there’s really a more important game in town now than adding up the number of formal diplomatic allies. This new game in town probably started around February 2021 with the Biden administration moving into the White House. To many people’s and particularly Beijing’s surprise, Biden kept Trump’s tough China policy. He also introduced into his speeches and policies a clear and consistent autocracy-vs-democracy contrast.

Within the context of this U.S.-led “reframing” of the global picture, Taiwan now has the opportunity to reposition itself within the team democracy global network of supporters in a way that it’s not strictly about formal recognition and UN membership. It’s about being recognized, and in some ways, held up as an important force in this network of democracies.

Flannery: How will Taiwan’s presidential elections next year affect these three-way ties?

Cooke: From the U.S. governmental standpoint, the outcome – whether it is a victory for Tsai’s Democratic Progressive Party or the opposition KMT party – will change hardly at all. This is because the U.S. government’s official position – whether it involves the outcome of an election in Taiwan or changes to the cross-strait status quo initiated by China – is that what the 24 million people of Taiwan choose for themselves is what the U.S. government will support. I don’t think our basic diplomatic posture and our support for Taiwan would change unless there was some evidence — which I would not expect at all — of some malfeasance happening with the election.

Flannery: What do you make of China’s probe into Micron?

Cooke: We can dissect it into several elements. One is a desire for reciprocity and being seen on an equal plane. And so with Biden’s CHIPS Act, and the singling out of TikTok and a lot of different Chinese companies in U.S. security investigations, it’s to be expected that there is going to be some reciprocal action that China is going to want to take to be seen as a peer power demanding reciprocity.

That diplomatic posturing is understandable but it does have a chilling effect for potential foreign investors — definitely on the U.S. business community. Close allies in Europe and elsewhere notice it, and it doesn’t help China’s post-pandemic effort to show a welcoming face to foreign investment.

I think there is also a third element of it that is interesting: perhaps as another data-point showing a lack of coordination in Chinese policy and messaging that we see from time to time. And we’re living in a world where nobody is a paragon and the U.S. has its own challenges with coordinating its message. But in China, as we saw recently with ‘wolf-diplomacy’ and the balloon incident, people lower in the governmental hierarchy vie to please their superiors, and end up getting out in front of the intended policy and in front of what would be an optimal coordinated policy for China. And I’m wondering personally whether Micron might be an instance of that.

Flannery: Speaking about both semiconductors and Taiwan, does the U.S. rely on Taiwan too much for chips?

Cooke: It’s actually in almost everyone’s interest at this point to have a greater degree of global diversification. It’s outright dangerous to have close to 90% of production of the world’s most advanced semiconductors taking place only 90 miles away from the Chinese mainland.

Flannery: Does the CHIPS Act go far enough in striking a new balance?

Cooke: Before the CHIPS Act, Taiwan Semiconductor Manufacturing Company (TSMC) was already taking steps (to diversify from Taiwan). There are currently moves afoot in Germany for automotive chip production — not the most advanced chips in the world — but also with Japan for consumer electronics and with Arizona for an advanced generation of chips. (See related post here.) For the foreseeable future, production of ultra-advanced chips will stay in Taiwan. But I think a lot of production capacity for quite advanced chips is being pushed out of Taiwan to these other global nodes.

The CHIPS Act is to my mind pretty fascinating. As a response to China’s Made-In-China-2025 ambitions and its military upgrading, it’s a bulls-eye in my view. But, as a policy undertaking in the U.S. domestic context, it is something of a potential third rail in the sense that, as a country, we’ve never been comfortable or particularly skilled at industrial policy. And it is clearly industrial policy.

Interestingly, I think there is enough bipartisan support right now that the industrial policy-political debate on Capitol Hill is not the traditional debate of “no industrial policy” versus, let’s say, the Clinton era’s “auto industrial policy for Japan.” Nobody at this point seems to be openly challenging the need for an industrial policy response to China’s advanced technology challenge.

So the debate currently is one about “clean” industrial policy versus industrial policy with social agenda items folded into it, like childcare support for workers. (Either way) it is important as a signal to the market about U.S. government resolve.

Flannery: Is it enough? And if it’s not enough, what’s the next step?

Cooke: If, in version one, the sum had been significantly higher than $52 billion, it would have been almost setting itself up for failure, because there are so many things that can go wrong in operationalizing and implementing something like this.

By analogy in the military sphere, we have put in a very robust sanctions regime against Russia following the invasion of Ukraine. But it was kind of uncharted territory. There’s been a lot of analysis about what’s been working and what hasn’t been working. We’re groping our way forward and want to keep some powder dry.

The CHIPS Act is similar in the commercial sphere — kind of uncharted territory. One of the things it has going for is that Commerce Secretary Gina Raimondo is an astute leader of the process. In the current political environment, any sign of dropping the ball would be pounced on. What is actually more important than the amount of money is the fact that it has happened in an initial iteration. There can be subsequent iterations, but it’s important to operationalize the first iteration as well as possible and to learn from that process to inform a potential second iteration.

Flannery: There is controversy about social goals being attached to it.

Cooke: The Act was passed by Congress last year, and it went into a kind of holding period where no one knew what the process was going to be for a company to apply. When the guidelines were only recently announced, it became clear that there was quite a lot of conditionality put on the ability of a company to apply. One set of conditions has to do with an applicant limiting its China business for a 10-year period. Another quite different set has to do with an awarded company providing childcare for its employees.

I think the criticism about these conditions is a fairly predictable output from the Washington DC political meat grinder. Because these are tax-payer dollars, the back-and-forth is highly political. Placing limitations on future China business for awardees makes sense to the average American voter. However, those limitations raise serious concerns for the CEO of a sizable company that doesn’t want to decouple from the China market but does want to access CHIPS Act support. On the separate issue of childcare, this requirement is meant as an incentive to help overcome the problem of a shortage of chip production workers in the U.S but it obviously becomes a red meat talking point for politicians who position themselves as anti-woke in U.S. culture wars skirmishing.

This goes back to what we were talking about before with Micron. China is currently unable to respond in a meaningfully reciprocal way when the U.S. does things like put Chinese billionaires onto an entities list. They just don’t have a global finance tool that is anywhere near as sharp and strong as is found in the U.S. Treasury toolkit. For the U.S., putting companies on an entities list works— it catches the attention of targeted individuals and there is an important and broad public messaging dimension to it as well. Of course, to make sanctions really bite, there’s a lot of operationalization that needs to happen but doesn’t always happen.

What I personally believe is: China’s main effort now is to try to knock the dollar off its post-World War II throne. Others have tried and failed and it will be a hard thing for China to pull off. But I believe that’s this the main thrust of their effort and the primary aim of a long-term, patient strategy.

See related posts:

U.S. Businesses Look To De-Risk, Not Decouple, Their China Ties

U.S.-China Collaboration Could Cut Development Time, Cost For New Cancer Treatments

TSMC Will Triple Arizona Investment To $40 Billion, Among Largest Foreign Outlays

Taiwan’s Biggest Silicon Wafer Maker Eyes U.S. Solar Industry Investment

@rflannerychina

Send me a secure tip.

(End article)

I join Russell in inviting you to leave your thoughts or questions in the Comment section below. (Because of netizen ire in China, I have not always kept the Comments section open in Assessing China but it is open for this post. I would love to hear from you).

I’ll give my wrap on the conclusion of the 20th Party Congress in Beijing later in the week after some further digestion and rumination.

Meanwhile, here’s a graphic putting today’s market reaction to Xi’s consolidation of power into some context. Entirely different timelines and denouements but same implacable forces at work …

Throughout WWII, the U.S., the Soviet Union and the Kuomintang (KMT) Party of China were formal allies. But in 1949, Mao Zedong’s Chinese Communist Party (CCP) forced the KMT to flee to Taiwan. On October 1st 1949, Mao formally announced the founding of the People’s Republic of China. The strategic triangle shifted as the U.S. lost a putative (and highly authoritarian) KMT ally in China and the Soviet Union gained a Communist comrade-in-arms with the CPP.

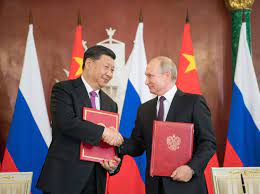

The chumminess of this 1958 photo of Mao Zedong and Nikita Khrushchev belies the deep rifts — both ideological and geopolitical — which had been developing in the Sino-Soviet relationship since 1956. Despite efforts to patch over the differences, the divisions continued to grow until Mao announced the split in 1964 followed by a series of formal statements. Monolithic global Communism had ceased to exist.

Fifty years ago today, Air Force One touched down in Beijing bringing President Nixon and the First Lady for their historic meeting with Mao Zedong. The Nixons’ visit to China lasted from February 21-28, 1972. It was then followed by years of rapprochement efforts — including the historic performance by the Philadelphia Orchestra in 1973 — and culminated in the establishment of formal diplomatic relations between the U.S. and China under President Carter in 1979. The Soviet Union was left out in the cold.

Today — February 21, 2022 — Russia announced its formal recognition of two breakaway, largely Russian-speaking enclaves in eastern Ukraine. The post-WWII order of sovereignty, rule of law, and cooperation is being challenged. Two weeks earlier, Xi Jinping chose to support Putin’s Ukraine power-play, overturning decades of official “Five Principles of Peaceful Coexistence” policy. The U.S.-China-Russia ground has shifted yet again.

Looking back on these seventy-five years of U.S.-China-Soviet/Russia relations, I expect that I will always pause to reflect on February 21 as each year passes. February 21, 1972 was deeply promising. February 21, 2022 is deeply foreboding. In a professional sense, today’s date will likely be for me somewhat like what I feel personally as other calendar days each year remind me of my mother’s and father’s deaths (and of their lives). Artificial and arbitrary dates on a calendar which nonetheless carry deep and lasting human meaning and consequence.

On January 13th of this year, President Trump abruptly ordered the termination of the U.S.-China EcoPartnership Program. Seven days before leaving office and without notice, Trump turned the lights off on this 10-year old program, pulling the rug out from under 36 committed and on-going bi-national projects to lower carbon-emissions at global scale.

The Biden Administration is assessing its options for re-vitalizing, in some shape or form, this model of innovative and impactful public-private collaboration to put a dent in global greenhouse gas emissions. This might involve replication of the program to India. ReGen250 is already in the starting gate with a U.S. Mid-Atlantic/State of Maharashtra candidate program should that take shape, as is described on pages 8-9 of our article published last month in the peer-reviewed science journal Environmental Progress and Sustainable Energy.

In the meanwhile, we are pressing forward with unofficial support from the two U.S. Government agencies which ran the EcoPartnership program for ten years — the U.S. Department of State and the U.S. Department of Energy — on a purely private and sub-national basis. Our goal in China looking forward is to explore the possibility of expanding from a regional effort (low-carbon collaboration between the U.S.-Mid-Atlantic and the Jing-Jin-Ji (京津冀) region of Beijing, Tianjin and Hebei Province to national scale.

How will we accomplish this without the direct support of the U.S. Government? The first step was to confirm the Biden Administration’s encouragement of trade with China in support of Paris Accord goals and then to renew our region-to-region BE Better program partnership with our primary partner in China, the TEDA EcoCenter. These steps were taken last quarter.

The next steps involve exploring prospects for the resumption of the Sino-U.S. Eco Park national-level opportunity with the Green Development League as outlined at the 2020 U.S.-China EcoPartnership Summit. (As described in detail in a prior post, the Green Development League comprises the 36 top-ranked NETDZs throughout China and the GDL Secretary-General is our original EcoPartnership partner (the TEDA EcoCenter and its Director Madame Yuyan Song).

As the exclusive U.S.-based working group member for the proposed Sino-U.S. Eco Park, China Partnership would leverage expertise and input from (1) our region-to-region BE Better program partners (experts in “energy-efficient, smart and healthy built environments” for industrial park users) as well as (2) our U.S.-China BEST Cities partners (with additional constituencies of support to include the U.S.-China Business Council, the U.S. Industry Advisory Board of the U.S.-China Clean Energy Research Center for Building Energy Efficiency (CERC-BEE), the National Governors Association, and the National League of Cities) in order to identify a comprehensive range of U.S. clean energy technologies and infrastructures from across eastern, central and western regions of the United States to be incorporated into the Sino-U.S. BE Better Eco Park model.

The primary impact of this milestone — CPGP’s formally joining the Green Development League’s working group for design of a Sino-U.S. Eco Park with scalability and replicability to multiple locations throughout China — is literally “to put the U.S. on the map” alongside eight other similar International Eco Parks already functioning in China under PRC Ministry of Commerce auspices. These eight other Eco Park projects represent mostly Sino-European collaborations (e.g., Sino-German Eco Park, Sino-Swiss Zhenjiang Eco Park, Sino-Austrian Eco Park, Sino-Finland Beijing Eco Park) and, to date, none represents a Sino-U.S. collaboration. The CPGP/U.S.-China BEST Cities model was selected, following the March 27, 2018 deadline for application, due to its unique structure of open collaboration designed to introduce U.S. urban clean energy infrastructures and technologies to TEDA and the 35 other top National Economic-technological Development Zones (NETDZ) in the Green Development League.

Using comparables drawn from the realized, real-world experience of the Sino-German Eco Park in Dalian but adjusted to account for the relatively greater GDP of the U.S., a Sino-U.S. BE Better Eco Park leveraging our EcoPartnership’s platform of energy-efficient, smart, healthy built environment and clean manufacturing for industrial park application should reasonably be expected to realize within its initial 5 years:

• As many as 300 signed project agreements (with nearly 60% of those either in production or under construction during that timeframe) representing total investment of 100 billion RMB (approx. USD 15 billion at today’s exchange rate)

• As many as 90 of these projects would be expected to fall in the high-end manufacturing and new energy field with total investment of 67.5 billion RMB (approx. USD 10 billion at today’s exchange rate)

• As many as 80 of these projects would be expected to fall in the advanced services sector with total investment of 35 billion RMB (approx. USD 5 billion at today’s exchange rate)

We are now actively exploring the most practical route for realizing this goal which would involve resumption, post-Trump Administration, of our primary partnership model with (a) TEDA, (b) the 36 GDLs and (c) the 219 NETDZs. Additionally, we have recourse to a secondary partnership model focused on the Jing-Jin-Ji/Xiongan New Area mega-development project.

With respect to the 35-year macroeconomic development effort ushered in by Deng Xiaoping and the Shenzhen and Pudong macro-development projects, Xiongan has both continuities and distinctive differences. One similarity is the size envisioned for the Xiongan New Area -– roughly 50% bigger than Pudong (east of Shanghai) and slightly larger than Shenzhen (to the north of Hong Kong). While Xiongan can be thought of as culminating the coastal progression of these macro-projects–- starting in the south with Shenzhen in the 1980s and moving to the central coast with Pudong in the 1990s -– the final, northern leg of this triad was wobbly at first. President Hu Jintao and Premier Wen Jiabao initially envisioned the third macro-project leg as being Binhai to the northeast of Tianjin. Post-2012, however, plans for Binhai lost most of their momentum and it was only with President Xi Jinping’s emergence in power that priority was shifted from Binhai to Xiongan. It is more in the discontinuities between Xiongan and the earlier Shenzhen and Pudong macro-projects that Xiongan’s significance can best be understood. The first 30 years of the PRC’s post-Cultural Revolution industrial development was based on a high-carbon model. (This is frequently referred to in China by the phrase 先污染后治理 meaning “pollute first, clean up (or remediate) later”). In contrast, the Xiongan industrial model championed by Xi Jinping focuses on a different set of values for the next 30-year-or-so phase of China’s development in the 21st century: the goals of (1) promoting and putting into practice low-carbon industrialization and sustainability innovations and (2) lessening social inequality and narrowing the gap between rich and poor in shared benefits of industrialization and economic development.

President Biden’s first in-person appearance on the world stage included a tense but business-like meeting with Vladimir Putin, a NATO meeting in which NATO solidarity was vociferously reaffirmed and a meeting of G7 leaders in which the perceived threats of climate change and China both loomed large.

The final agreement announced at the conclusion of the G7 last Sunday featured two elements with direct bearing on China and, particularly, on China’s Belt & Road Initiative (BRI): a commitment to phase out coal-fired electricity generation and a revived commitment to provide $100 billion in green finance assistance to developing countries. Both commitments were, however, long on symbolism and short on substance.

Today’s post looks at why the headlines for both announcements were printed in such large banner font, why the accompanying stories were so short in column-inch detail and why both stories serve to center on China at a meeting – involving the heads of state of the U.S., Canada, the U.K., Germany, France, Italy and Japan – where China is not represented.

The electricity generation commitment undertaken by the seven leaders was specifically that their governments would provide no new support for thermal coal power generation except in cases where carbon capture and sequestration (CCS) technology is deployed in tandem to neutralize the greenhouse gas (GHG) emissions produced by coal-firing. This undertaking supports a previous G7 commitment to halve emissions by 2030 (against a 2010 baseline) on the way to achieving net-zero emissions by 2050.

The green finance commitment announced announced Sunday – to provide $100 billion annually to help developing countries decarbonize – was not in fact a new commitment but a reaffirmation of an earlier commitment which had lapsed during the Trump years. It was rolled out on Sunday with a new name – the Build Back Better World Initiative – but with no new funding attached.

Seen from a global perspective, both commitments are intended as a direct response to China and its Belt and Road Initiative. China’s trajectory of domestic high-growth has resulted in it recently surpassing the GHG emissions of the entire developed world combined, according to a recent report by the Rhodium Group. Compounding this unfavorable trend, China continues to support its Big Coal industry by encouraging exports of coal-fired power generation equipment to its less developed BRI partner countries. The G7’s electricity generation commitment is therefore intended to draw a sharp contrast in climate change global leadership between the G7 group of democracies and the China’s competing, more authoritarian model. Similarly, the green financing commitment is intended as an alternative pool of financing for developing countries to draw on separate from Chinese government lending and the BRI-focused Asian Infrastructure Investment Bank (AIIB).

So what accounts for the splashy headline but dearth of detail? Two factors. The first is the very evident desire of the other six countries to welcome the U.S., post-Trump, “back into the club” by explicitly amplifying in the international arena President Biden’s domestic Build Back Better theme; and, more importantly, by presenting a show of implicit support for Biden’s “Summit of the Democracies” strategy for countering China. In short, the symbolism was more important than the actual substance for achieving this goal.

Hammering out the details of the power generation agreement and expanding on the scope of the green finance commitment eluded the G7 leaders at this meeting due to a lack of confidence, especially among the three leaders from Continental Europe, that detailed and expanded agreement will stick. There are three levels of doubt contributing to this lack of confidence. In order of ascending importance, there is:

- Uncertainty over how Biden and his National Security Council deputies Kurt Campbell and John Kerry are going to square heightened competition with China in the technology space with attempted renewal of cooperation with China in addressing climate change;

- Doubt over the ability of the Administration to get its proposals through a closely-divided and highly-partisan Congress; and

- Concern that the American public’s fling with climate science denial and Trumpian America First thinking might not be a one-time affair and could come to the fore again in the 2022 mid-term election and the 2024 Presidential election.

Given these doubts, any effort to provide substantive detail for the power generation agreement and to expand the green financing agreement would have been prone to failure and could have undercut the paramount goal of projecting renewed G7 solidarity and democratic unity. Looked at from another angle, this result shows how much effort and hard work will be required to reestablish the global momentum toward 2050 climate goals following Trump’s decision to pull America out from the Paris Accord Conference of Parties (COP) process.